The Payment Service Provider (PSP) Licence is one of the most sought types of business permits for financial companies in Seychelles. The PSP business model is quite common in the current business environment to address increasing need of online users and online sellers (or service providers) to do business through internet.

The Seychelles Payment Services Provider Licence can be applied through registration of a company in Seychelles. The payment service provider offers businesses the ability to accept payments electronically via credit cards, direct debits, bank transfers, and real-time bank transfers.

There is a requirement to register a company first and then apply for the PSP Licence with the Central Bank of Seychelles under the company name.

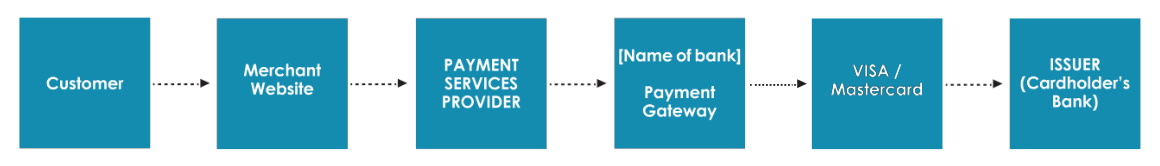

The PSP should normally have an agreement with an Acquiring Bank for onboarding of the merchants. The Acquiring Bank will normally provide the second gateway.

There are 2 types of licences under the Payment Services Provider which are as follows:

1. Money Remittance Licence

a) means a service for the transmission of money (or any signed. representation of monetary value), without any payment accounts being created in the name of payer or payee where funds are received for the sole purpose of transferring a corresponding amount to a payee or to another payment service provider.

2. Other Payment Services Licence

a) services enabling cash deposits and withdrawals

b) execution of payment transactions

c) issuing and/or acquisition of payment instruments

d) any other services functional to the transfer of money. This shall also include the issuance of electronic money and electronic money instruments. The term does not include the provision of solely online or telecommunication services or network access

• Minimum unimpaired capital of at least SCR 500,000 (USD 36,200 approx) or its equivalent for a Money Remittance Licence

• Minimum unimpaired capital of at least SCR 1,000,000 (USD 72,400 approx) or its equivalent for Other Payment Services Licence

• Our Company Application Form-to be completed and signed

• KYC documents on all the parties including passport copy, proof of address, Bank Letter of Reference, CV and other CDD documents.

A Detailed business plan - a template will be provided to client.

All documents / manuals / agreements to be submitted with application.

Premier specialises in providing professional services whether your need is to minimize tax or protect your wealth. We help you in setting up the right structure whether it is an onshore company, offshore company or offshore trust. The solutions we provide are adapted to your needs and are smartly structured. Our expert services include:

• Professional Advisory services

• Company Formations, Directorship, Secretarial and compliance

• Bookkeepping and Accountary Services.

• Licensed Trustee Services

• Foundation Services

• Offshore Funds (Hedge/Mutual Funds) Licence applications and advice

• Securities Dealer Licence applications and advice Investment Adviser/Manager Licence applications and advice

• Other Financial Activity Licence applications and advice

• Tax Compliance Services (for companies, trusts and foundation and individuals) such as:

• Tax Computations

• Annual and Quarterly Tax filings

• International Tax Structuring

• Premier Group (“Premier”) operates through three licensed companies - in Mauritius, in Seychelles and in Dubai.

• Our Mauritius office is licensed and regulated as a Management and Trust Company by the Financial Services Commis- sion of Mauritius.

• Premier is a Member of the INAA Group (www.inaa.org), an association of tax and accounting experts based worldwide in more than 50 countries ranked 14th worldwide among associations and alliances.

• Our office in Seychelles is licensed and regulated as an International Corporate Service Provider (ICSP) and International Trustee Services Providers (ITSP) by the Financial Services Authority of Seychelles.

• Our Seychelles office is a member of UHY, which is a network of independent accounting and consulting firms with offices in over 273 major business centres in 101 countries and is ranked 17th worldwide as a network involved in international audit, accounting, tax and consul tancy works.

• Our Dubai office is licensed by the Dubai Multi Commodities Centre (DMCC)and also an approved Registered Agent with Ras Al Khaimah International Corporate Centre (RAK ICC).

• Our Dubai office is a member of ISFIN, is an award-winning advisory that accelerates international business strategy which has a network of leading professional firms accredited in 75 countries.

• Being part of these international networks, Premier Group provides global, personalised, cost effective and value-added solutions to our clients with varying profiles to meet their specific objectives and handle international matters accordingly.