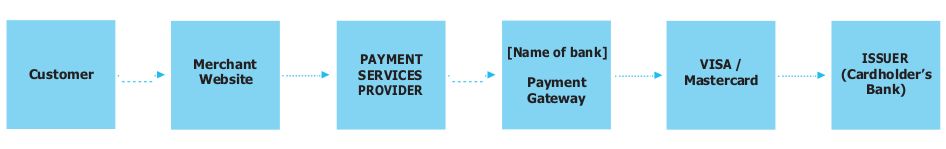

The Payment Intermediary Services Licence is of interest to those who wish to operate as a Payment Service Provider (PSP).

The PSP business model is quite common in the current business environment to address the increasing need of online shoppers and online sellers(merchants) to do business through the internet.

The Mauritius Payment Intermediary Services Licence can only be applied for under the category of a Global Business Company ( GBC). With such licence, the Mauritius GBC can offer Payment Intermediary Services (PIS) for accepting electronic payments by a variety of payment methods including credit card, bank-based payments such as direct debit, bank transfer, and real-time transfer based on online banking.

The main customer base is often composed of online merchant sellers. The PSP should normally have an agreement with an Acquiring Bank for onboarding of the merchants. The Acquiring Bank will normally provide the second gateway.

| CONDITIONS | REQUIREMENTS |

|---|---|

Two (2) main conditions for the successful applications for a PIS Licence are as follows: |

• Our Company Application Form – to be completed and signed. |

Minimum unimpaired capital of at least MUR 2,000,000 (USD 57,000 approx) or its equivalent. |

•KYC documents on all the parties including passport copy, proof of address, Bank Letter of Reference, CV and Personal Questionnaire. |

Operations Committee – The persons designated must be well experienced in the line of business. |

• A Detailed business plan – a template will be provided to client. |

In order to issue a GBC Licence, the Mauritius FSC considers whether the company has substance in Mauritius through its management and control. The following substance requirements have to be met:

1.The Company shall have at least 2 directors, resident in Mauritius;

2.The Company shall maintain at all times its principal bank account in Mauritius;

3.The Company shall keep and maintain, at all times, its accounting records at its registered office in Mauritius;

4.The Company shall prepare its statutory financial statements and causes such financial statements to be audited in Mauritius;

5.The Company shall provide for all meetings of directors to include at least 2 directors from Mauritius; and

The Company must meet, at all times, the following additional pre-defined substance requirements:

6. carry out its core income generating activities in, or from, Mauritius by:

(a) employing, either directly or indirectly, a reasonable number of suitably qualified persons to carry out the core activities;

(b) incurring a minimum level of expenditure, which is proportionate to its level of activities.

7.be managed and controlled from Mauritius; and

8.be administered by a Management Company.

Premier specialises in providing professional services whether your need is to minimize tax or protect your wealth. We help you in setting up the right structure whether it is an onshore company, offshore company or offshore trust. The solutions we provide are adapted to your needs and are smartly structured. Our expert services include:

• Professional Advisory services

• Company Formations, Directorship, Secretarial and Compliance

• Bookkeeping and Accountancy Services

• Licensed Trustee Services

• Foundation Services

• Offshore Funds (Hedge/Mutual Funds) Licence applications & advice

• Broker Licence applications and advice

• Investment Adviser/Manager Licence applications and advice

• Other Financial Activity Licence applications and advice

• Tax Compliance Services (for companies, trusts & foundation and individuals) such as:

• Tax Computations

• Annual and Quarterly Tax filings

• International Tax Structuring

• Filing of Declaration of non-residency for trusts and foundations

• Our client base is involved in various sectors from automotive, agriculture, aviation, banking, construction, digital services, financial, health, food, high tech, investment funds, legal, minerals, telecommunications, steel, transport and many more.

• Premier Group (“Premier”) operates through two licensed companies in Mauritius & in Seychelles.

• Our Mauritius office is licensed and regulated as a Management and Trust Company by the Financial Services Commission of Mauritius.

• Premier is a Member of the INAA Group (www.inaa.org), an association of tax and accounting experts based worldwide in more than 50 countries ranked 14th worldwide among associations and alliances.

• Our office in Seychelles is licensed and regulated as an International Corporate Service Provider (ICSP) and International Trustee Services Providers (ITSP) by the Financial Services Authority of Seychelles.

• Our Seychelles office is a member of UHY, which is a network of independent accounting and consulting firms with offices in over 273 major business centres in 101 countries and is ranked 17th worldwide as a network involved in international audit, accounting, tax and consultancy works.

• Being part of these international networks, Premier Group provides global, personalised, cost effective and value-added solutions to our clients with varying profiles to meet their specific objectives and handle international matters accordingly.

• Premier’s Promoters and Directors have been in financial services sector for more than a decade and have managed companies and trusts holding assets of nearly US$1 billion in aggregate.

• The Directors and key staffs are members of the Society of Trust and Estate Practitioners-STEP), Fellow Chartered Certified Accountants (FCCAs), Legal, Accounting, Economics and Tax professionals who hold UK qualifications and experience.

• The support team members are dedicated professionals and graduates from reputable institutions. A high standard of service is guaranteed all the time.

• Premier offers a high-quality level of personalized service with a global care and helps each client to grow and succeed through our presence in major financial centers.

• Premier has the expertise and experience in setting up the right structures for investments into Africa. We provide solutions on the right structure including legal matters and provisions for Double Taxation Treaties so that clients are aware of how to benefit.