The Securities Act 2007 and rules and guidelines allow for Securities Dealer companies to be set up and licensed in Seychelles. Securities Dealer means means a person who carries on the business of dealing in securities, or who holds himself out as conducting such business as mentioned below:

• makes or offers to make an agreement with another person to enter into or offer to enter into an agreement, for or with a view to acquiring, disposing of, subscribing for or underwriting securities or in any way effects or causes to effect a securities transaction

• causes any sale or disposition of or other dealing or any solicitation in respect of securities for valuable consideration, whether the terms of payment be on margin, instalment or otherwise or any attempt to do any of the foregoing

• participates as a Securities Dealer in any transaction in a security occurring upon a securities exchange

• receives as a Securities Dealer an order to buy or sell a security which is executed

• manages a portfolio of securities for another person on terms under which the first mentioned person may hold property of the other person

1. Any of the following securities:

• shares and stock of any kind in the share capital of a company in Seychelles or elsewhere

• shares or other units of participation in a mutual fund as defined in the Mutual Fund and Hedge Fund Act

2. Debentures, debenture stock, loan stock, bonds, certificates of deposit and any other instruments creating or acknowledging indebtedness other than

• any instrument acknowledging or creating indebtedness for, or for money borrowed to defray, the consideration payable under a contract for the supply of goods or services

• a check or other bill of exchange, a bankers draft or a letter of credit

• a bank note, a statement showing a balance in a current, deposit or savings account, a lease or other disposition of property

• a contract of insurance

• any instrument creating or acknowledging indebtedness in respect of money raised by the Government of Seychelles or any public authority created thereby; and

• an instrument creating or acknowledging indebtedness & creating security for that indebtedness over land.

3. Warrants and other instruments entitling the holder to subscribe for securities falling within paragraph 1 or 2

4. Certificates or other instruments which confer contractual or proprietary rights

• in respect of any security falling within paragraph 1,2 or 3 being a security held by a person other than the person on whom the rights are conferred by the certificate or instrument; and

• the transfer of which may be effected without the consent of that person.

5. Options to acquire or dispose of:

• a security falling in any other paragraph of this Schedule

• any currency

• any precious metal; or

• an option to acquire or dispose of a security falling within this paragraph by virtue of the above

| Corporate Tax | 1.5% applicable on the assessable (gross) income |

|---|---|

| DTAA Benefits | Yes |

| Minimum Share Capital | USD 50,000 |

| Application Fee (Govt) | USD 1,500 |

| Annual Fee (Govt) | USD 3,000 |

| Financial Statements | File audited financial statements within 4 months of the financial year end |

| Compliance Officer | A compliance officer shall be appointed who will be responsible for the maintenance of adequate systems and controls to ensure compliance with the Act |

| Directors | At least 2 natural directors must be appointed |

| Representative | At least one individual who is licensed as a Securities Dealer Representative must be employed |

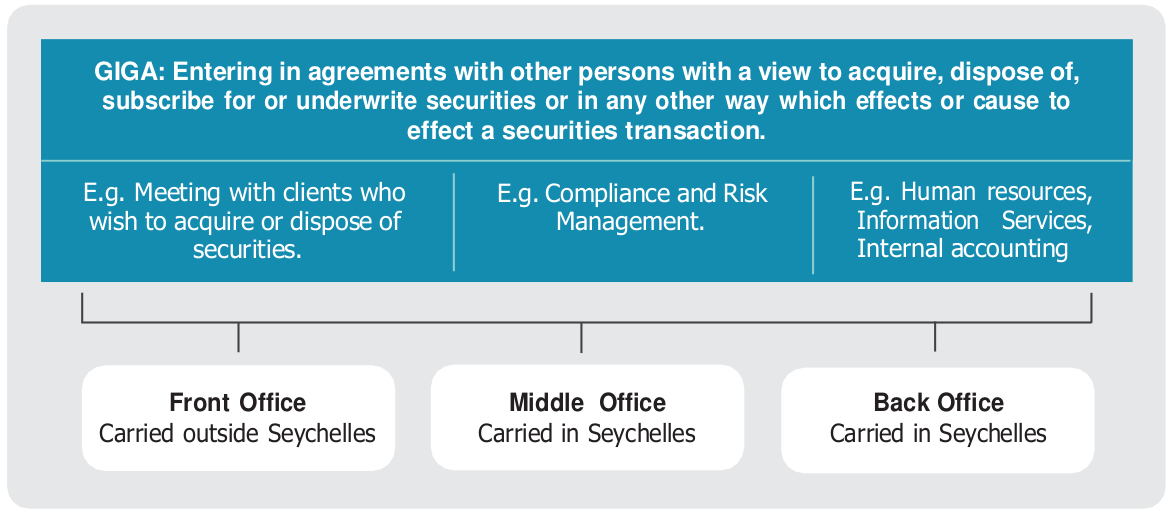

In order to meet the substantial activity requirements, the Core Income Generating Activities of the Securities Dealer must be undertaken in a physical office in Seychelles by:

1) employing an adequate number of suitably qualified persons to carry out the core income generating activities; and

2) incurring an adequate amount of operating expenditures for such activities.

The substantial activity requirements are considered to have been met if the middle office and back-office activities are conducted in Seychelles even though the front office activities may be undertaken outside Seychelles.

The Securities Dealer companies are particularly beneficial for Brokerage Houses operating worldwide since:

• Seychelles has the advantages of having a modern and flexible Securities Law.

• It issues clear Securities Dealer licences within reasonable time, requires reasonable capital requirements, charges reasonable licence fees and has a low tax rate.

• Seychelles is one of the best places to save on costs and at the same time, client can enjoy the array of services providers in the country.

UHY Premier Financial Services Limited provides the following main services with respect to the activities of the Securities Dealer:

• Structuring services

• Licence Application and renewal of Securities Dealer Licence

• Provision of registered office address

• Provide professional directors and qualified secretary resident in Seychelles

• Open bank accounts

• Preparation of quarterly accounts and filing with authorities

• Prepare and file tax returns

• Premier Group (“Premier”) operates through two licensed companies in Mauritius & in Seychelles.

• Our Mauritius office is licensed and regulated as a Management and Trust Company by the Financial Services Commission of Mauritius.

• Premier is a Member of the INAA Group (www.inaa.org), an association of tax and accounting experts based worldwide in more than 50 countries ranked 14th worldwide among associations and alliances.

• Our office in Seychelles is licensed and regulated as an International Corporate Service Provider (ICSP) and International Trustee Services Providers (ITSP) by the Financial Services Authority of Seychelles.

• Our Seychelles office is a member of UHY, which is a network of independent accounting and consulting firms with offices in over 273 major business centres in 101 countries and is ranked 17th worldwide as a network involved in international audit, accounting, tax and consultancy works.

• Being part of these international networks, Premier Group provides global, personalised, cost effective and value-added solutions to our clients with varying profiles to meet their specific objectives and handle international matters accordingly.

• Premier’s Promoters and Directors have been in financial services sector for more than a decade and have managed companies and trusts holding assets of nearly US$1 billion in aggregate.

• The Directors and key staffs are members of the Society of Trust and Estate Practitioners-STEP), Fellow Chartered Certified Accountants (FCCAs), Legal, Accounting, Economics and Tax professionals who hold UK qualifications and experience.

• The support team members are dedicated professionals and graduates from reputable institutions. A high standard of service is guaranteed all the time.

• Premier offers a high-quality level of personalized service with a global care and helps each client to grow and succeed through our presence in major financial centers.

• Premier has the expertise and experience in setting up the right structures for investments into Africa. We provide solutions on the right structure including legal matters and provisions for Double Taxation Treaties so that clients are aware of how to benefit.